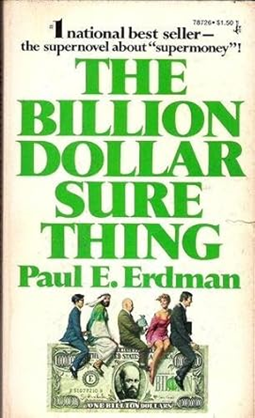

Book Review 2025.05: The Billion Dollar Sure Thing, (1973 Novel), Paperback 255 pages, April 1t, 2025

The US initiated Global Tariff War dominating the world news prompted me to pick up this book. This was the thriller that I had read three decades ago in my college days which had ignited my interest in financial thrillers. My collection of over 25 books of this genre is a testimony to my continuing interest. Paul Erdman, the author had a chequered career as the CEO of a Swiss bank, who jumped bail when arrested for a bank failure in Switzerland to turn author with this book creating a new category of financial thrillers that became popular in the 1970s.

This novel is set in the turbulent financial markets of early 1970s that saw the end of the three decades old Bretton-Wood’s system of fixed foreign exchange rates that gave birth to the current market determined foreign exchange markets, a period comparable to the current volatile global tariff war. It paints a vivid picture of the macro-economic events that resulted in the devaluation of US$, leading to the soaring gold prices.

The motives of all the major players -the US government, the European Bankers, the Soviet government, and the private speculators is clearly spelt out in this fictional account, providing the reader deep insights into the economic rationale for the way financial markets function. Further the story set in the backdrop of Swiss bank, with its secret numbered bank accounts and their role in market making for gold is a gripping tale for all those interested in financial markets and economics.

A quaint feature that hits the reader today is the 1970s idea of classifying people in novels, especially crime thrillers like James Hardly Chase that is followed in this novel too. Youth are people in 20s, 30s constitutes middle age and a fifty-nine years man is described as grandfather of five to categorize him as old. The narration is fast paced and gripping moving between the various financial centers of Europe, even as the economic rationale underlying the transactions are explained through conversation between the characters without disrupting the flow.

As a faculty teaching corporate finance and foreign exchange management for more than a decade, one of my incomplete goals is of developing course material on economics, finance and financial markets using financial thrillers at the core. In this endeavour, authors like Paul Erdman and his dozen books provided the inspiration and the material for it. I do hope someday soon, we will have a financial thriller based on the global tariff wars that explains the rationale for and against tariffs to help a larger audience to appreciate the motives for initiating such drastic volatility that saw equity markets propelled on a roller coaster ride putting at risk the retirement corpus of many middle-class families.

Happy Reading of this and other financial thrillers like The Petro-dollar Takeover to complete a graduate course in corporate finance and financial markets.

Social Profiles